Do you want to open a restaurant in Madrid? Learn how to here!

Opening a restaurant or a tapas bar in Madrid could be challenging. The regulations, authorities, permits, and licenses change depending on the municipality you choose. In addition, Spain currently offers a critical outlook for the self-employed and SMEs, so you should consider your options well before taking the first step. In this article, I will talk to you about the following:

- The different procedures you must take into account before opening a restaurant in Madrid.

- And some practical tips so you can create your restaurant.

From now on I warn you that undertaking in Spain is not like in other countries – it’s not a simple process, but that depends on the road you take. Here, we’ll help you figure out the easiest way you can get things done, and have your restaurant operating in less than two months. Let's get right into it!

Bureaucracy in Spain is a Big Hurdle – So Big, You Can Walk Under It!

Undertaking in Spain is complex due to the bureaucracy that each step of the entrepreneurship process entails. Still, opening a restaurant is one of the best alternatives you can use to start a business in Madrid. This is because:

- Hospitality and gastronomy are a vital part of both the Autonomous Community of Madrid and the entire country.

- That makes restaurants one of the activities most likely to be profitable.

The thing is, Spaniards know their system is a little bit complex. You can view this in two ways:

- It’s difficult to open a restaurant because all the bureaucracy makes it complex.

- Or it’s easy to open a restaurant because all you have to do is hire someone to help you during the process.

There is an entire culture that leads you to skip several steps for the comfort of entrepreneurship, which might come as a shock to you. Spaniards usually take the easiest road and hire someone to take care of all the bureaucratic processes for them. That’s why I took inspiration from that to tell you about the easiest way you can undertake in Madrid in the following steps.

1. Choose the Way in Which You Will Operate: Legal Entity or Individual

As in other countries, in Spain, you must decide how you are going to operate your business. Basically, you have to decide if you will operate as one of the variations of self-employment, or as one of the many types of corporation. This is up to you, but the most common ways these types of businesses are started is as self-employed or autónomo. In Spain, being self-employed is the equivalent of a sole proprietorship. There are two ways to be self-employed:

- Self-employed or autónomo(with unlimited liability): In short, this type of self-employed person is responsible for all their debts with their entire estate. There are also certain obligations you must meet, such as paying taxes on your earnings and social security. This is preferred because it does not require a lot of bureaucracy – the process can even be done shortly before starting. If you’re starting, you must pay a flat fee of 60 euros per month for the first year, which is great. After the first year though, you’ll start paying higher fees depending on how much you make as a self-employed person, starting with 294 euros. That fee can increase up to 1266 euros.

- Entrepreneur with Limited Liability (ERL or Emprendedor con Responsabilidad Limitada): This type of self-employed person offers the advantage that you can protect your real estate – or habitual residence, as it is officially called. The ERL requires other procedures in the Mercantile Registry and the Property Registry to designate the property you want to protect.

The other most common form of entrepreneurship is creating a Limited Company(Sociedad Limitada or SL). This is a type of company in which the capital of more than one person joins, there is a minimum initial capital, and you can better protect personal assets. However, the SL has different and more complex tax obligations, which makes necessary spending on incorporation fees, paperwork, accounting management, legal counsel, and more.

You must study your alternatives very well since each one has important advantages and disadvantages. For example, if you are self-employed it is more difficult to obtain financing – it is much easier for SLs to obtain it. Still, you can start as a self-employed person or as an ERL, and form an SL later when your venture gains traction.

2. The Commercial Premises and the Opening and Activity License

Another of the complex aspects of undertaking in Spain is the high initial cost of opening a restaurant if you buy commercial premises. It is expensive because you have to carry out several procedures, ranging from the authorization of the commercial premises with technical reports to obtaining the opening and activity license. This is where Spaniards give up the most, and that’s where we’re not going with this article.

The most common alternative throughout Spain is to carry out a business transfer. Transfers are common because they help you skip all the red tape of starting from scratch. Basically, you will be looking for a commercial space that someone is already leasing to buy the right to lease, occupy, and operate in the space.

In general terms, these are the steps you must follow:

- Get a transfer agent, a legal advisor, or a real estate advisor.

- Search with the help of your advisor for a commercial premise that suits your needs.

- Create a transfer contract together with the current owner and tenant. Sign the transfer contract with the current tenant.

- Then you must transfer the opening and activity license at the Madrid Town Hall or Ayuntamiento. Without this license, you cannot operate the business, so it is a vital part of the process.

Take precautions!

It is important that you understand that this is a negotiation process that must be supervised by legal advisors to avoid wasting money and time. The cost of a transfer varies greatly depending on the size of the premises, client portfolio, operating accounts of the previous business, equipment that is included in the transfer, and even employees. It is important that you take the following precautions:

- Check the current tenant's lease. This way you make sure that there are no limitations such as the time left on the contract before renewing. Many people make the mistake of transferring, only to run out of time to build their business because the owner refuses to renew the contract.

- It is a good idea to include the owner in the negotiations. Although it is not illegal for the transfer to take place without the owner’s intervention, it is a good idea to start building a relationship in advance.

- The owner may increase the cost of the rent by up to 20% after the transfer, so you should keep that in mind before deciding on a commercial space. The rent may make the business unprofitable with that 20% more.

- Be sure to double-check business numbers, conduct up-to-date market research, and conduct an independent evaluation prior to the transfer. This way you will have bases to better negotiate the transfer or to take the offer as soon as possible in case it’s a great deal.

Although this all sounds like a complex process, it is still less complex than starting from scratch!

Rental Costs, Quarterly, Annual Payments, and Other Operating Costs

After the transfer, you will have to start paying rent, together with security and guarantee deposits. You must also take into account other obligations, such as the following:

- The IBI (Impuesto Sobre Bienes Inmuebles) or Real Estate Tax.

- Fees for public sanitation, pest control, fire extinguishers, and other security mechanisms.

- The monthly quotas of self-employment. Self-employed people must pay a starting fee of 20% of their earnings, which increases depending on how much money they make. And you must also pay the flat 60 euro fee, which again, increases after the first year.

- Companies must pay a flat fee of 25% on their earnings.

- The VAT or IVA (Impuesto Sobre el Valor Añadido) refund, is a quarterly payment of 10% on each item on your menu.

You will also have to take care of registering your employees in Social Security and other expenses that depend on the regulations of the jurisdiction under which you are within the country. You can learn more here.

3. Cost of Renovations, Menu Creation, and Other Expenses

After making the transfer successfully and before you start operating your restaurant, you must take care of making the necessary renovations so that the business is competitive. As I recommended before, it is a good idea to do a market study. This way you will know exactly how to adapt your restaurant in terms of:

- Restaurant decoration.

- Menu and gastronomic offer.

- Marketing and branding strategies.

- Type of restaurant service.

- And more.

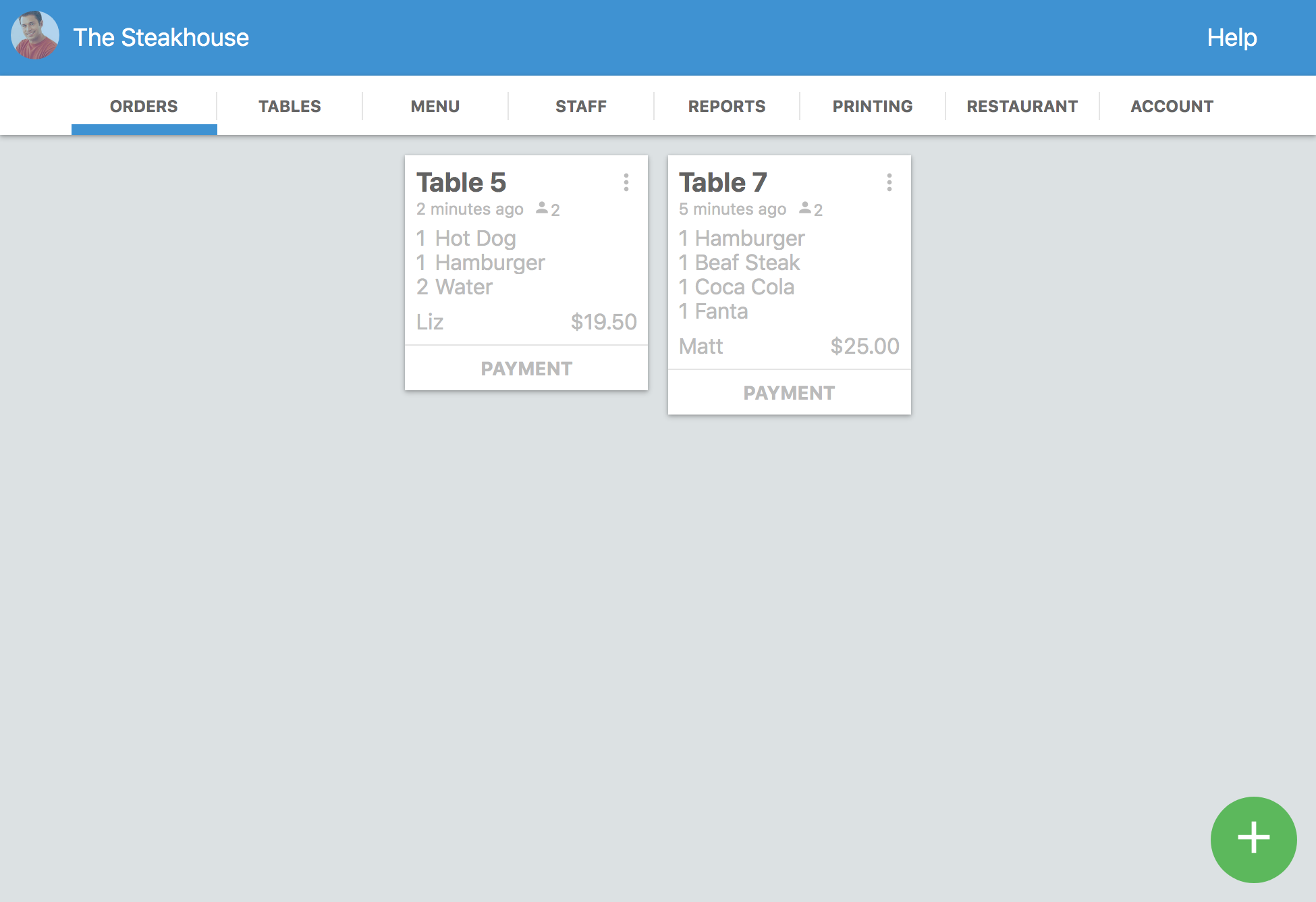

Another thing you should consider in advance is your POS system or point of sale. This is an important factor because it must be adapted to your needs as an entrepreneur and to the needs of your customers – not to mention the needs of a modern restaurant. That is why we recommend that you study the best POS systems that are available to you. An example of a great POS system is Waiterio. With our software, you can manage your restaurant in an efficient, versatile, and totally convenient way. You can run your restaurant from your smartphone!

How much does it cost to open a restaurant in Madrid?

The costs of opening a restaurant in the Autonomous Community of Madrid depend a lot on the city where you are. If you are in the city of Madrid, the costs are much higher, since it is the city with the largest population and competition. The costs can add up to more than 100.000 euros, although again, this depends on many factors. The priority cost is the transfer, and you can get transfers even for less than 20.000 euros. However, the expenses do not end there, since as I mentioned, you must consider equipment expenses, remodeling, employees, rent, and more. That means that you can open a restaurant with less than 40.000 euros if you plan your investments well and if it is a small or medium-sized establishment.

Opening a restaurant in Madrid is not impossible

Although I started this article warning about the difficulties of starting a business in Spain, now you know that it is not impossible. In fact, as I mentioned, restaurants are an incredibly profitable alternative to start your journey to financial freedom in Madrid. What is clear is that to be able to achieve it in Spain you must:

- Have adequate support at each step of the process. This will help you avoid delays and start making money as soon as possible.

- Look for the easiest way to start your business. Starting from scratch is almost impossible, especially if it is for the first time.

- Create a gastronomic offer that can compete with the high standards of the country.

Do you think you have what it takes to open a restaurant in Madrid?

![How to Open a Restaurant in Madrid [Full Guide]](https://www.imagelato.com/images/open-restaurant-madrid-spain-35846f58-1024w.jpg)